pioneer status malaysia

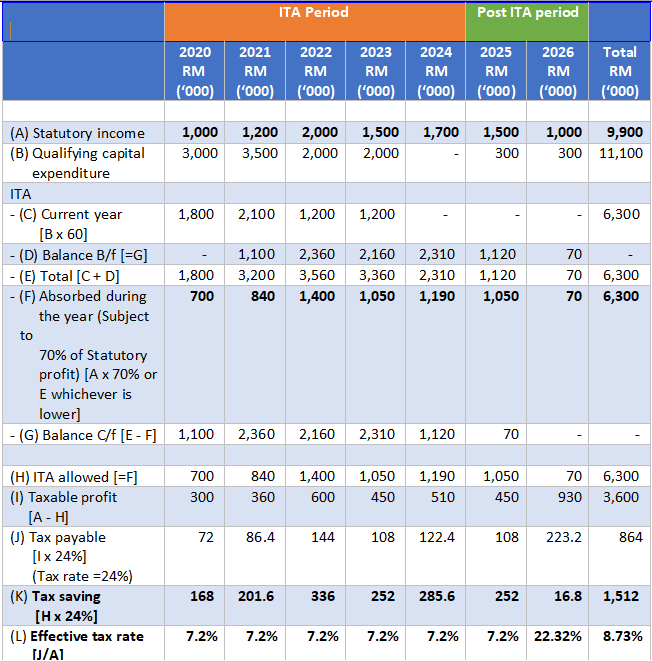

Application for Determination of Effective Date of the Investment Tax Allowance Incentive. Investment tax allowance which grants you 100 deduction on capital qualifying expenditure that includes hardware and software and purchase or renovation of building and landscaping in Cyberjaya.

Pin On The 20 Most Innovative Companies To Watch 2019

Malaysia offers a wide range of tax incentives ranging from tax exemptions allowances to enhanced tax deductions.

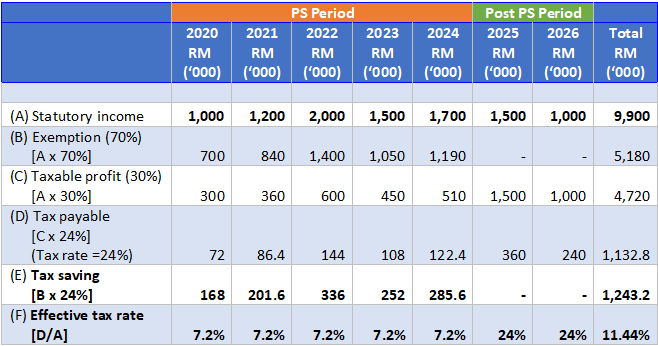

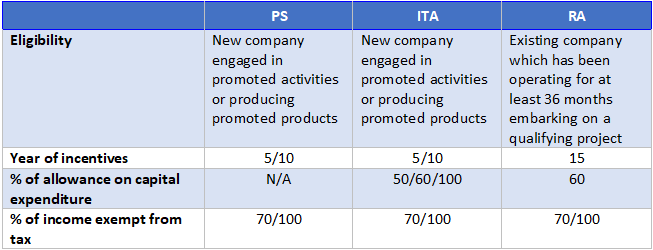

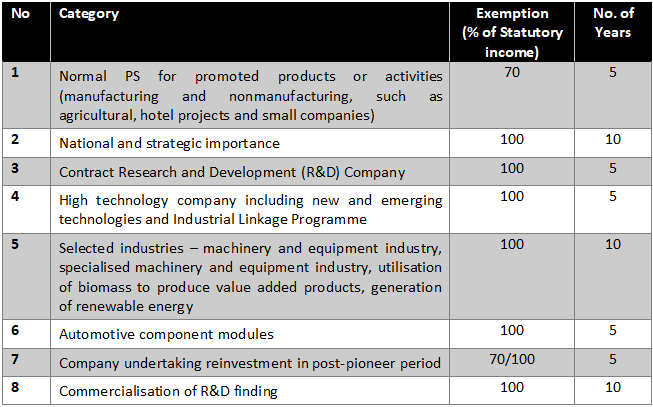

. Pioneer status often provides a 70 exemption of statutory income for a period of 5 years. Some of the major tax incentives available in Malaysia are the Pioneer Status PS Investment Tax Allowance ITA and Reinvestment Allowance RA. It pays tax on 30 of its statutory income with the exemption period commencing from its Production Day defined as the day its production level reaches 30 of its capacity.

A pioneer status which grants you 100 tax free on taxable statutory income for up to 10 years on MSC Malaysia Status approved qualifying activities. 14 rows Approval of pioneer status by a company producing a product or participating in an activity of. Malaysia provides investment incentives such as a pioneer status and an investment tax allowance to foreign manufacturing companies.

The Hotel and Tourism Pioneer Status Application checklist was designed to be easy to use and is perfect for general managers tourism and hospitality site owners convention and visitors bureaus and others in the hospitality industry and tourism industry who are applying for Pioneer Status in Malaysia. While pioneer status is an income-based tax incentive investment tax allowance is a capital expenditure-based. There are many types of tax incentives provided by Malaysian Government to attract foreign or local investors for investment in certain industries in Malaysia.

In this article we will explain the main three types of tax. The company employs more than 500 persons. Companies can now submit their applications for Pioneer Certificate and track its status online via InvestMalaysia Portal at investmalaysiamidagovmy.

The Malaysian government extends a full tax exemption incentive of fifteen years for firms with Pioneer Status companies promoting products or activities in industries or parts of Malaysia to which the government places a high priority and ten years for companies with Investment Tax Allowance status those on which the government. Application for Pioneer Certificate. A pioneer status company exemption period can be renewed on expiry provided the Government is satisfied that.

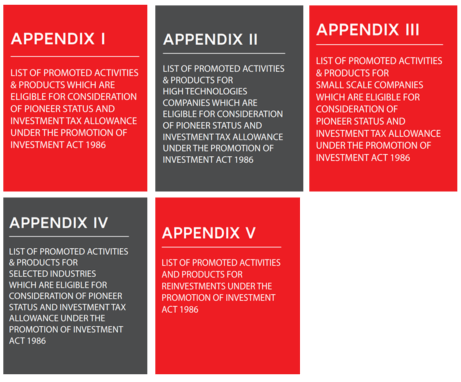

Pioneer Status Salient points. Pioneer Status PS is an incentive in the form of tax exemption which is granted to companies participating in promoted activities or producing promoted products for a period of 5 or 10 years. The tax incentives are provided in forms of exemption of profits allowance for capital expenditure or double deduction of expenses.

9 rows Pioneer status PS and investment tax allowance ITA Companies in the manufacturing. Pioneer status and investment tax allowance are two of the main tax incentives available in Malaysia. Capital allowances are not deducted.

Pioneer status is granted for an initial period of 5 years commencing from the production day as determined by the Ministry of International Trade and Industry MITI. Pioneer status and investment tax allowance are two of the main tax incentives available in Malaysia. These Acts cover investments in the manufacturing agriculture tourism including hotel and approved services sectors as well as.

I Pioneer Status A company granted Pioneer Status PS enjoys a five year partial exemption from the payment of income tax. In Malaysia tax incentives both direct and indirect are provided for in the Promotion of Investments Act 1986 Income Tax Act 1967 Customs Act 1967 Sales Tax Act 1972 Excise Act 1976 and Free Zones Act 1990. The proposed investment incentives were to be offered to Fortune 500 companies and global unicorns in the high technology manufacturing creative.

The salient features of these incentives are discussed below. Pioneer Status is a status granted by The Malaysian Investment Development Authority with the aim to transform Malaysias best and most promising businesses into the most competitive enterprises in global export markets. Pioneer Status privilege granted with a five 5 five 5 year 100.

MSC Malaysia status is recognized by the Government of Malaysia. Adjusted business income from a pioneer activity is fully exempted from tax. Pioneer Status PS The standard PS incentive is a partial exemption from the payment of income tax for a period of 5 years up to 70.

These ICT and ICT-facilitated businesses can utilise the support of the Multimedia Development Corporation MDeC to develop or use multimedia technologies to produce and enhance their products and services. Generally tax incentives are available for tax resident companies. It pays tax on 30 of its statutory income with the exemption period commencing from its Production Day defined as the day its production level reaches 30 of.

Pioneer status often provides a 70 exemption of statutory income for a period of 5 years but it is possible to extend both the quantum and the. I Pioneer Status A company granted Pioneer Status PS enjoys a five year partial exemption from the payment of income tax. Malaysia to its UNRELATED companies can enjoy - PIONEER STATUS PS with Income Tax exemption of 100 on statutory income for 5 years OR INVESTMENT TAX ALLOWANCE ITA of 100 of qualifying capital expenditure incurred within a period of 10 years and can be offset against 70 of statutory income for each year of assessment.

What is MIDA pioneer status. The company has fixed assets excluding land with a value in excess of 25m Malaysian ringgits USD66m. Pioneer status and investment tax allowance are main tax incentives available from BKAT 3023 at Northern University of Malaysia.

Promoted Activities Mida Malaysian Investment Development Authority

Cyberjaya Infographics Real Estate News Infographic Everyone Knows

For Rent Vertical 2 Offices Bangsarsouth Msc Status Part Furnished Various Sizes Rm5 60psf Call 012 278 91 Property For Rent Rent Top Kitchen Cabinets

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

Vyrox Software Team Started Software Development Engineering Since 2008 Our Services Cover Smartphone Mobile Iot Smart Home App Development Software Projects

Acca Atx Mys Pioneer Status Part 2

Pioneer Status Investment Tax Allowance And Reinvestment Allowance Acca Global

Pioneer Status Investment Tax Allowance And Reinvestment Allowance Acca Global

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

Iscistech Business Solutions Malaysia Softwarecomany Malaysiancomany Itcompanymalaysia Itoutsourcingmalaysia Business Solutions Outsourcing Solutions

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

Comments

Post a Comment